County Ordinances

Signs

Real Estate Signs are permitted in residential and commercial districts. The allowable size, height, and setback of the sign is determined by the zoning district and the size of the property. Signs must be located a minimum of 10 feet inside the property line.

Open House Signs may only be displayed on supervised open house days, between the hours of 10:00 am and 5:00 pm. No flag, pennants, balloons, or other attention attracting devices may be used. One Open House sign may be placed in the County right-of-way abutting the subject property no closer than 10 ft. from the edge of the roadway. (No permit is required.)

Signs shall not exceed 4 square ft. and 4 ft. in height.

Signs shall not be placed in any median.

Signs placed at an intersection may not exceed 29 inches in height.

Signs shall not interfere with the visibility of pedestrians or motorists.

Signs shall not be lighted or illuminated.

This relates to [Ord. 04- 41, Sec. 5.06.00, 5.06.07, and 5.06.10]

Number of Dwelling Occupants

The limit to the number of occupants residing in a home is based on square footage per occupant. The requirements are as follows:

250 sq ft for the first occupant

200 sq ft for each additional occupant Example: A 1500 sq. ft. home could have 7 occupants in the home. No more than 4 unrelated individuals per household.

This relates to [Code of Laws and Ordinance, Section 22-231(13)]

Accessory Structures

All vertical structures require a building permit and must meet setback requirements, structural codes and/or have tie downs. This includes the following structures: Pools, Sheds, Canopies, Guest Houses and Detached Garages

This relates to [Ordinance 04-41, Section 10.02.06 (B)]

Local Business Tax

No person shall engage in or manage any business, profession or occupation anywhere in Collier County, including within municipalities, for which a local business tax is required by this article unless the required local business tax receipt shall have been issued by the Collier County Tax Collector or in some instances, the tax collector in another Florida County. A separate receipt shall be required for each geographic location (situs) of the respective business, profession or occupation. The tax receipt shall be issued to each person upon the tax collector's receipt of the applicable local business tax and upon compliance with other applicable requirements.

Code of Laws and Ordinances, Section 126-111

Home Occupations

There shall be no retail sale of materials, goods, or products from the premises.

The home occupation shall be clearly incidental to the use of the dwelling for dwelling purposes. The existence of the home occupation shall not change the character of the dwelling.

An allowable home occupation shall be conducted by an occupant of the dwelling.

There shall be no on-site or off-site advertising signs.

The use shall not generate more traffic than would be associated with the allowable residential use. To that end, traveling to and from as well as meeting or parking at the residence by either employees of the business operated therefrom who are not residing at the subject address or by customers or clients of the home occupations is prohibited.

There shall be no receiving of goods or materials other than normal delivery by the U.S. Postal Service or similar carrier.

Parking or storage of commercial vehicles or equipment shall be allowable only in compliance with the requirements for commercial vehicles in the County Code.

The on-site use of any equipment or materials shall not create or produce excessive noise, obnoxious fumes, dust, or smoke.

The on-site use of any equipment or tools shall not create any amount of vibration or electrical disturbance.

No on-site use or storage of any hazardous material shall be kept in such an amount as to be potentially dangerous to persons or property outside the confines of the home occupation.

There shall be no outside storage of goods or products, except plants. Where plants are stored, no more than fifty (50) percent of the total square footage of the lot may be used for plant storage.

A home occupation shall be subject to all applicable County occupational licenses and other business taxes.

Short Term Rental Business Tax Receipt Requirement

A business Tax Receipt is required for Short Term Rentals pursuant to Collier County Code of Laws and Ordinances, Chapter 126, Section 126-127.

SEC. 126-127. - HOTEL, APARTMENT HOTEL, MOTEL, ETC., AS DEFINED IN CHAPTER 509, FLORIDA STATUTES.

(a) Every person engaged in Collier County in the business of renting accommodations, as defined in Chapter 509, Florida Statutes, shall pay for each respective place of business (situs) the amount of $1.50 for each such rental unit. No place of business shall pay less than $15.00 for such local business tax receipt. The maximum total tax for the rental units at one situs shall not exceed $1,000.00. The unit count to be used in this section shall be the same as used by the Florida Division of Hotels and Restaurants of the Department of Business Regulation under Chapter 509, Florida Statutes.

(b) The tax collector shall not issue a tax receipt to any business coming under the provisions of this section until a license has been procured for such place of business in Collier County from the Florida Division of Hotels and Restaurants of the Department of Business Regulation under Chapter 509, Florida Statutes.

Short Term Rental Registration Requirement

Beginning January 3, 2022, Collier County Ordinance No. 2021-45 requires property owners to register their short-term vacation rental. The intent is to collect current and accurate information regarding short-term vacation rental properties, encourage the appropriate management of these properties, and protect the general health, safety, and welfare of the residents and visitors to Collier County. This ordinance pertains to property owners of short-term rentals in unincorporated Collier County. It does not pertain to properties located in the City of Naples, City of Marco Island, or Everglades City.

Short-Term Vacation Rental means the rental of any habitable space, including a room, apartment, living quarters, in any residential building, including but not limited to condominiums, single-family or multi-family homes, for a term of six months or less, as provided in F.S.§125.0104(3)(a), as amended, unless such person rents, leases, or lets for consideration any living quarters or accommodations which are exempt according to the provisions of F.S. Ch. 212. Any owner who is not required to register with the Florida Department of Business and Professional Regulation (DBPR), as defined by F.S. Ch. 509, is exempt from this ordinance. Per LDC section 5.03.03, guest houses may not be leased or rented.

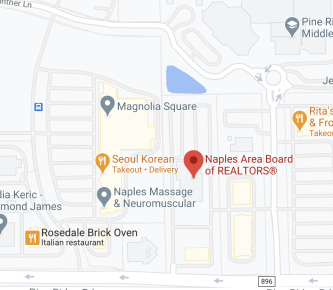

City of Naples Ordinances

Real Estate Signs

1 "for sale," "for lease," or "for rent" sign and 1 "open house" sign for each parcel of property for each street on which the parcel fronts, when such signs have an area per face of not more than 4 square feet, except as is further limited within single-family residential zoning districts. Off-site and "sold" signs are not permitted.

This relates to [City of Naples Code of Ordinance 50-39]

Transient Lodging

A transient lodging facility includes a unit, group of units, dwelling, building, or group of buildings, within a single complex of buildings rented to guests more than three times in a calendar year for periods of less than 30 days or one calendar month, whichever is less; or which is advertised or held out to the public as a place regularly rented to guests for periods of less than 30 days or one calendar month, whichever is less. It does not include condominium common elements.

This relates to [City of Naples Code of Ordinances 44-8; Ordinance 08-12309]

Storm Water Ordinance

The City of Naples Storm Water ordinance increases a development site’s or existing structure’s storm water management system's retention and detention capabilities and incentivize impervious greenspace, best management practices and disincentive designs that focus on maximizing impervious areas.